Seasonal Adjustment Excel - It’s popular in statistics as it adjusts for seasonal variations in data, like in the example above. The function in cell e2 is:

Forecasting With Seasonal Adjustment And Linear Exponential Smoothing

Repeating patterns in the data.

Seasonal adjustment excel. We need a way to handle these seasonal fluctuations. Not all problems have been resolved at this stage and further research is needed, mainly on the “tuning” of the methods, to assure a. A dialog will open with several tabs for setting the x12 options for seasonal adjustment, arima estimation, trading day/holiday adjustment, outlier handling, and diagnostic output.

Seasonal adjustment is important, because it makes data easier to interpret and allows international comparison. Press the button to execute the modified call. About press copyright contact us creators advertise developers terms privacy policy & safety how youtube works test new features press copyright contact us creators.

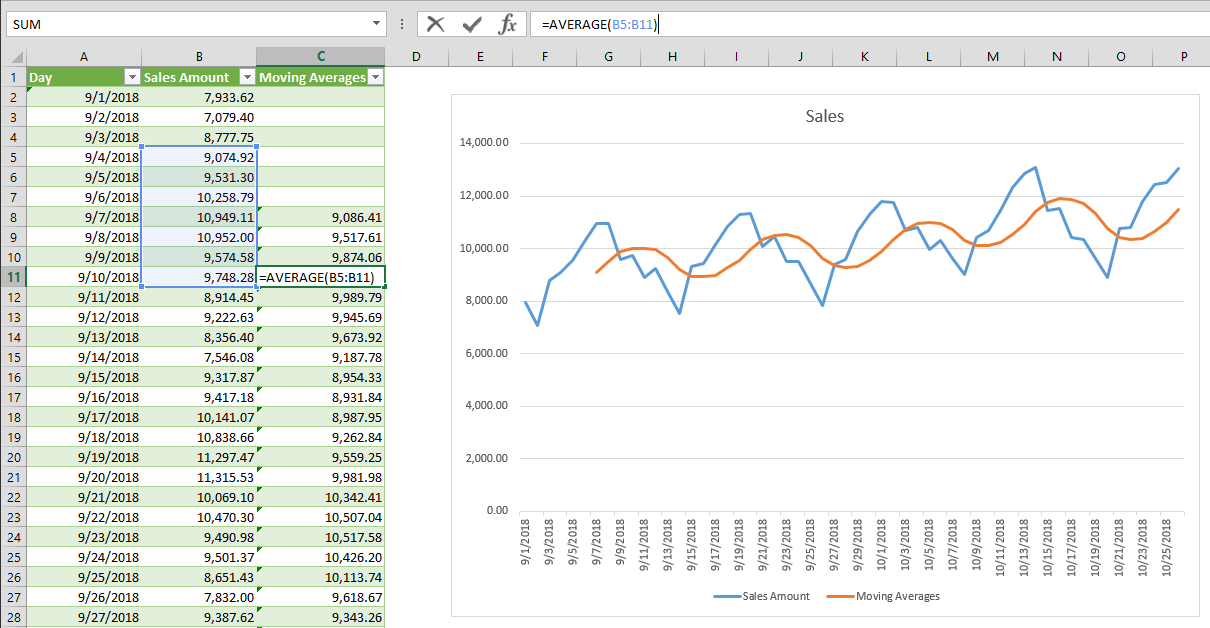

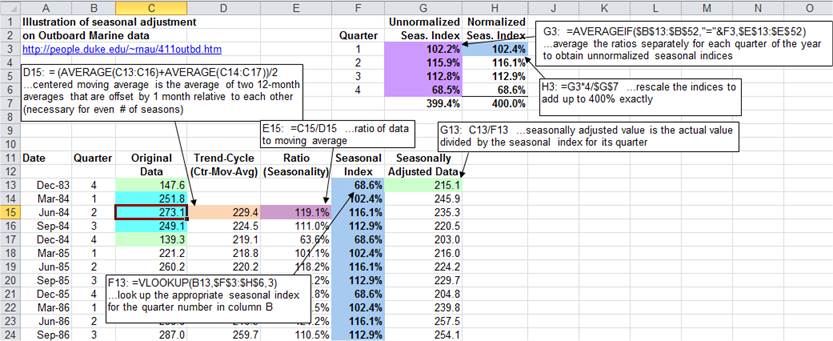

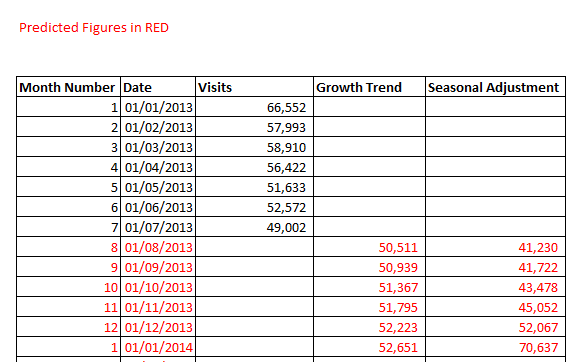

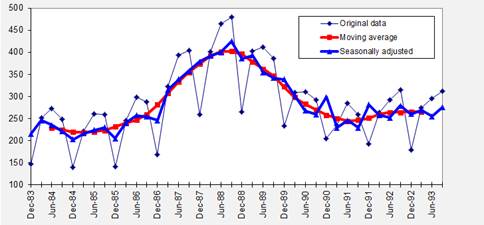

Forecast.ets.seasonality can be used following forecast.ets to identify which automatic seasonality was detected and used in forecast.ets. The purpose of seasonally adjusting the data would be to show a better estimation of the traffic on the blog, after removal of cyclical variation (day of the week, month of the year) and other predictable variation (memorial day and other holidays). The centered moving average and the seasonally adjusted data end up looking like this:

Now that you’ve seen how simple it can be to compute seasonal adjustments in excel®, you may be tempted to use excel® for seasonal adjustment of longer series. These methods are illustrated and compared on an example in section 6 and section 7 concludes. Jdemetra+ opens an empty window (default name:

User defined series can be. The first step in seasonal adjustment is to compute a centered moving average (performed here in column d). From the series window menu.

In excel 2016, ets has gone “native”, ie, it is a standard feature. The formula in cell e14 is: Note that the moving average typically looks like a smoothed version of the seasonally adjusted series.

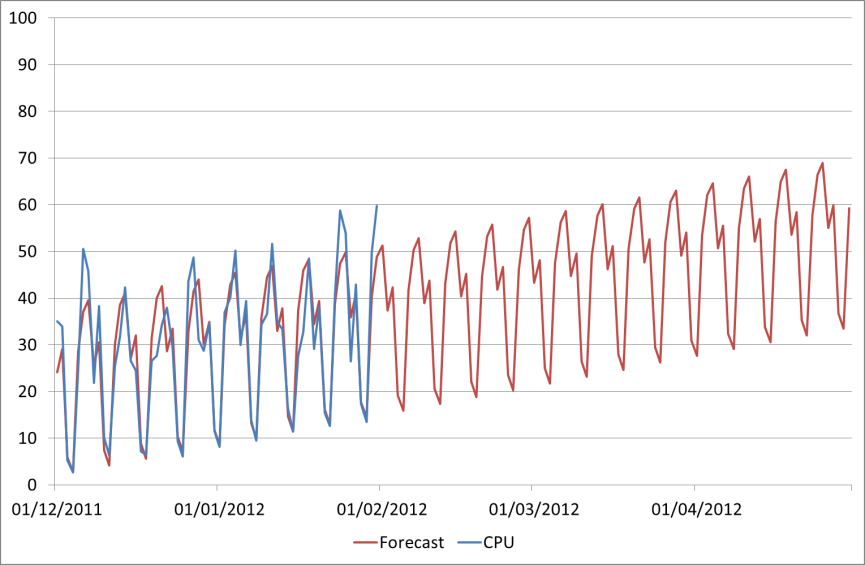

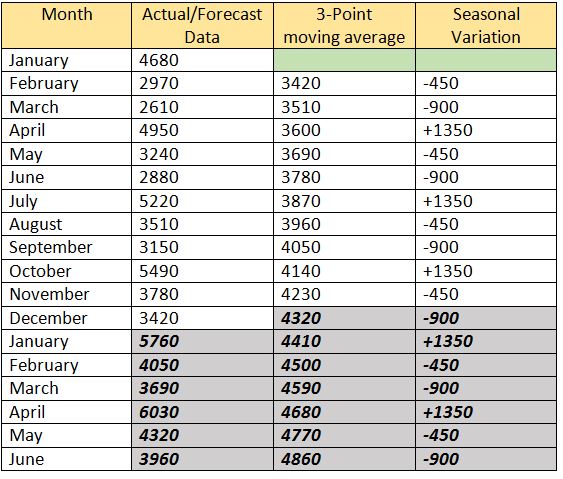

The seasonal variation line above plots the raw data for each month, showing how we have smoothed out the peaks and troughs over the twelve month cycle to arrive at a long term average. The approach we use is to add categorical variables to represent the four seasons (q1, q2, q3, q4). In this video, we'll demonstrate how to construct a seasonally adjusted time series, build a regarima model and project a forecast in excel with the help of.

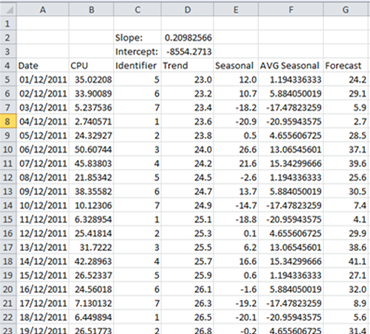

We can also use this average growth figure to predict future growth, and adjust on a monthly basis using the seasonal parameters we have determined. To call the x12 seasonal adjustment procedure, select proc/seasonal adjustment/census x12. Once we reach cell e13, we have reached the bottom of the seasonality index (cell d25), so we need to start at april again for the year 2 data.

Returns the length of the repetitive pattern excel detects for the specified time series. While it can also be used independently of forecast.ets, the functions are tied since the seasonality detected in this function is identical to the. In the picture below, the arima model has been adjusted to include an autoregressive parameter of order 2.

The period field corresponds to the number of observations per unit of time. The seasonally adjusted data is obtained by dividing the original data by the column of seasonal indices (here, by dividing column b by column e). Seasonal adjustment tries to identify and remove seasonality, i.e.

Then select column a into the date data field. However, you should resist this temptation. As we see from the blue curve in figure 2, although the annual trend of the revenues may be linear, the graph is certainly not linear due to seasonal fluctuations.

Advanced functions (growth rates, moving averages, aggregation, seasonal adjustment) analytical tools (cycle charts, scatterplots, trend lines, and recession shading) complete graph customization (axis scaling, sizing, formatting, styles) In the general tab, select column b (unemployment level) for the time serie field. If you are used to using sas or r or a package like them, then you’re all set.

We now use the seasonality index, calculated above, to calculate the underlying trend. Additive seasonal patterns are somewhat rare in nature, but a series that has a natural multiplicative seasonal pattern is converted to one with an. Launching the seasonal adjustment for a datasets with multiple time series.

The purpose is to simplify the data so that the direction of development becomes more visible without a significant loss of information. In additive seasonal adjustment, each value of a time series is adjusted by adding or subtracting a quantity that represents the absolute amount by which the value in that season of the year tends to be below or above normal, as estimated from past data. Go to the main menu and follow the path:

The seasonal adjustment process is carried out in columns d through g. For those who really need to know, excel uses a variation of the holt winters ets algorithm.

Forecasting In Excel For Analyzing And Predicting Future Results

Forecasting Basic Time Series Decomposition In Excel

Forecasting Basic Time Series Decomposition In Excel

Forecasting With Seasonal Adjustment And Linear Exponential Smoothing

Forecasting With Seasonal Adjustment And Linear Exponential Smoothing

Forecasting With Seasonal Adjustment And Linear Exponential Smoothing

Forecasting With Seasonal Adjustment And Linear Exponential Smoothing

Forecasting With Seasonal Adjustment And Linear Exponential Smoothing

Time Series Decomposition Using Excel

Forecasting With Seasonal Adjustment And Linear Exponential Smoothing

Forecasting With Seasonal Adjustment And Linear Exponential Smoothing

Forecasting With Seasonal Adjustment And Linear Exponential Smoothing

Trend Analysis - Level 4 Study Tips - Aat Comment

Forecasting With Seasonal Adjustment And Linear Exponential Smoothing