Shorting Home Equity Mezzanine Tranches - Eisman liked the odds too much to question lippmann’s motives. The presentation was titled “shorting home equity mezzanine tranches.” to make money the lippmann way required buying credit default swaps on the worst sub prime mortgage bonds.

Why The Housing Recovery Is Nearly Homeowner-less

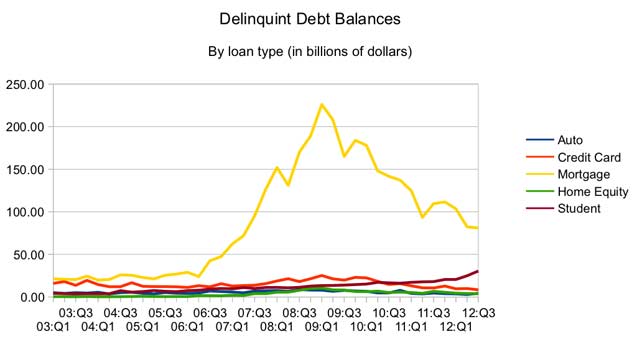

The percentage of subprime mortgages originated that were 10 mortgages grew from virtually zero in 2002 to around 30% in 2005 and 2006.

Shorting home equity mezzanine tranches. But why would lippmann be telling eisman and other investors to short the very same mortgage bonds his firm was trying to sell? In addition to stealing burry's work, lippmann has used an analyst named eugene wu to further solidify the idea that the subprime mortgage market is on fire. Buying luxury, explaining global imbalances investor letters

Introduction to the indian stock market. The better way to place a wager against a market that gosling peddles in the film is the strategy he describes in presentations that he makes to potential investors, “shorting home equity mezzanine tranches.” He was even giving talks around the country called shorting home equity mezzanine tranches, perhaps to as many as 250 investors.

Greg lippmann, a bond trader for deutsche bank, in an effort to attract investors created a presentation called “shorting home equity mezzanine tranches.” similar to michael burry, it was based on buying credit default swaps (cds’s) on the worst triple b slices of subprime mortgage bonds. “over 50% of outstanding subprime mortgages are located in msas [metropolitan statistical areas] with double digit 5 year average of annual home price growth rates. Lippman basically pitches burry's credit default swaps to eisman as a presentation entitled 'shorting home equity mezzanine tranches' (3.10).

He was even giving talks around the country called “shorting home equity mezzanine tranches,” perhaps to as many as 250 investors. 1314 see, e.g., 2/2007 presentation, “shorting home equity mezzanine tranches,” prepared by mr. The credit default swap is a contract sold as an insurance policy against the risk of bond default.

Eisman first learned how to short mortgage bonds this way from lippmann, as did john paulson. Shorting home equity mezzanine tranches. Lippmann also developed a presentation supporting his position entitled, “shorting home equity mezzanine tranches.” it made the following points:

Subcommittee interview of greg lippmann (10/18/2010). Shorting home equity mezzanine tranches (2007) [pdf] (static1.squarespace.com) 79 points by rococode 13 hours ago | hide | 36 comments: Shorting home equity mezzanine tranches (2007) [pdf] (static1.squarespace.com) 94 points by rococode on april 19, 2020 | hide | 40 comments:

A $2 to $10 investment could possibly result in a $100 gain. The affordability was getting more and more difficult. Rural marketing question bank 2011.

And this was his approach to steve eisman on the idea of betting against the subprime mortgage bond market. These products have become quite popular as home price increases until very recently outstripped wage growth.

Shorting Home Equity Mezzanine Tranches

Basic Cdo Security Structure Download Scientific Diagram

Shorting Home Equity Mezzanine Tranches Pdf Collateralized Debt Obligation Subprime Lending

Shorting Home Equity Mezzanine Tranches Pdf Collateralized Debt Obligation Subprime Lending

Shorting Home Equity Mezzanine Tranches

Short Equity T Long Mezzannine T Correlation Impact Bionic Turtle

2007 - Subprime - Shorting Home Equity Mezzanine Tranches 1 Pdf Collateralized Debt Obligation Securities Finance

Shorting Home Equity Mezzanine Tranches - Home Equity Mezzanine Tranches A Subsidiary Of Deutsche Bank Ag Conducts Deutsche Bank Investment Banking And Indicative And Are - Pdf Document

2007_subprime_shorting-home-equity-mezzanine-tranches-1pdf - Footnote Exhibits Page 0925 Strictly Private Confidential Shorting Home Equity Mezzanine Course Hero

Shorting Home Equity Mezzanine Tranches Pdf Collateralized Debt Obligation Subprime Lending

Multicurrency Note Programme Memorandum - Memorandum 3 The Notes May Be Subsequently Issued In Additional Several Tranches

Greg Lippmann - Famous 2007 Short Subprime Presentation Pdf

Multicurrency Note Programme Memorandum - Memorandum 3 The Notes May Be Subsequently Issued In Additional Several Tranches

The Big Short Primary Sources 3 Lots Of Data